Carbon Credit Controversies: Addressing Market Flaws

The carbon credit market, often touted as a critical tool in the fight against climate change, has its share of challenges and controversies. While it is designed to incentivize emission reductions and support sustainability initiatives, several issues have plagued its effectiveness and integrity.

Additionality and Credibility Issues

One of the fundamental issues with carbon credits lies in the concept of “additionality.” Additionality means that a project or activity funded by carbon credits should genuinely lead to emission reductions that wouldn’t have occurred otherwise. However, many projects fail to prove this, raising doubts about their credibility. Some argue that without the incentive of carbon credits, these projects might still have been undertaken, rendering the emission reductions claimed by the credits questionable.

Lack of Standardization

The carbon credit market lacks uniform standards and regulations. The absence of standardized methodologies for measuring and verifying emission reductions has led to discrepancies and inconsistency in the credits’ quality. This lack of standardization can also make it challenging for investors and buyers to evaluate the legitimacy and effectiveness of projects.

Double Counting

If a carbon credit is used by multiple entities to offset their emissions, its called Double Counting. This undermines the market’s integrity and inflates the perception of emission reductions. The absence of a global oversight body exacerbates the problem, as there is no universal system to prevent or monitor double counting.

Limited Scope of Offset Projects

Another issue is the limited scope of projects eligible for carbon credits. While reforestation and renewable energy projects are common, other emission reduction activities, such as improving energy efficiency in industrial processes or transportation, are often overlooked. A more comprehensive approach is needed to address emissions from a wider range of sectors.

Lack of Transparency

Transparency is a critical factor in the credibility of carbon credits. Many projects and credit-generating activities lack transparency in their reporting, making it difficult for stakeholders to assess the true impact of these initiatives. This opacity in reporting reduces trust and credibility in the market.

Environmental and Social Concerns

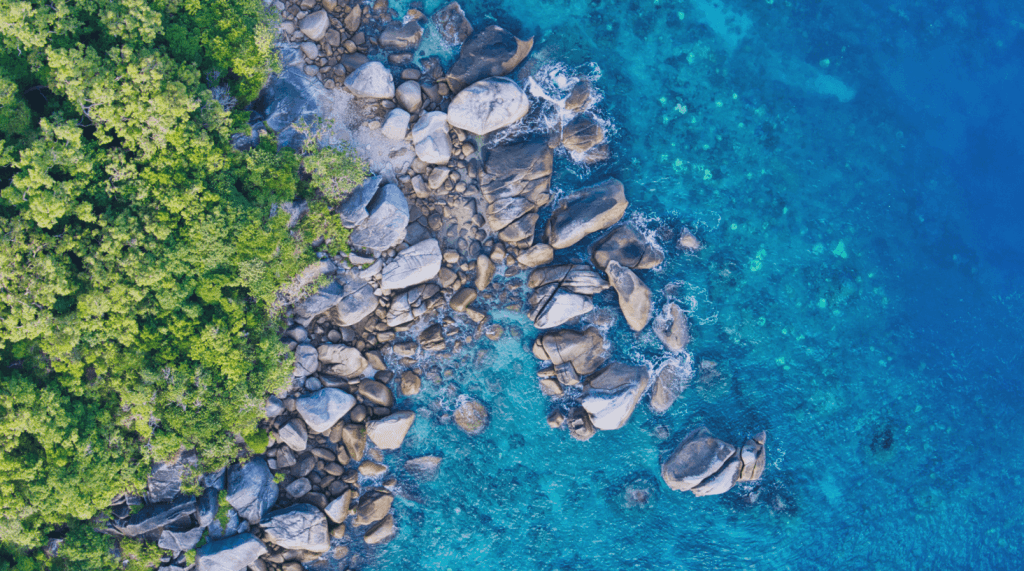

Carbon credit projects, particularly in forestry and land use, have raised concerns about their environmental and social impacts. Some reforestation projects have displaced local communities or negatively affected biodiversity. Ensuring that carbon credit projects uphold high environmental and social standards is a challenge that must be addressed.

Limited Accountability

The lack of accountability is a significant problem in the carbon credit market. When projects do not deliver the expected emission reductions, there is often little recourse for buyers or investors. Establishing mechanisms for accountability and ensuring that credits represent genuine emission reductions is essential to the market’s integrity.

Market Volatility

The carbon credit market can be highly volatile, with prices fluctuating significantly. This makes long-term planning and investment in emission reduction projects less predictable and attractive. A more stable and predictable market could encourage increased participation and investment.

Policy and Regulatory Uncertainty

The effectiveness of the carbon credit market is closely tied to government policies and regulations. Frequent changes in carbon pricing or cap-and-trade systems can create uncertainty for market participants. Stable and supportive regulatory frameworks are necessary to ensure the market’s viability.

A Flawed Remedy

The carbon credit market, despite its potential for positive change in the fight against climate change, faces credibility and effectiveness challenges, including additionality and standardization issues. Resolving these problems is crucial for carbon credits to play a significant role in global emission reduction efforts and sustainability as the world intensifies its battle against climate change.

About Coral

Coral is bringing clarity and trust to carbon markets. The Coral platform provides a simple and transparent solution to make environmental responsibility through carbon offsetting actionable by everyone. By ensuring complete transparency in the origin, certification, provenance and verification of each carbon credit and its environmental impact, Coral instills trust in market participants.

Related Articles